inheritance tax changes 2021 uk

Inheritance Tax Changes - What You Need To Know. Often referred to colloquially as death tax it is a levy that is placed.

Read a copy of the government response to the first OTS Inheritance Tax review.

. For exempt estates the value limit in relation to the gross value of the estate is increased from 1. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. The Office of Tax Simplification OTS.

The limit for chargeable trust property is increased from 150000 to 250000. Above this dividend income tax-free allowance you pay tax based on the rate you pay. On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the.

Inheritance Tax thresholds and interest rates. The tax is levied on the value at time of death and must be paid before the asset can. Gifts and other transfers of value IHT403 1 June 2020.

In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April 2026. Inheritance Tax Rate 2021 The nil-rate band of 325k is likely to change in the March budget as well as changes to rules regarding unused pension pots. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the.

Check if an estate qualifies for the Inheritance Tax residence nil rate band. 05 March 2020 1145. 15 October 2021 1423.

On 23 March 2021 the government announced that. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. Tax Day on 23 March 2021 announced that the excepted estates rules would be changed.

This guidance will be updated to reflect the Inheritance Tax reporting requirements announcement in the May 2021 newsletter which will come into effect from 1. The tax-free dividend allowance has stayed the same for the 2021-22 tax year at 2000. Jointly owned assets IHT404 19 April 2016.

Work out and apply the residence nil. Inheritance Tax reporting requirements. For lifetime gifts there would be no capital gains tax on the.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners.

Inheritance Tax Here S Who Pays And In Which States Bankrate

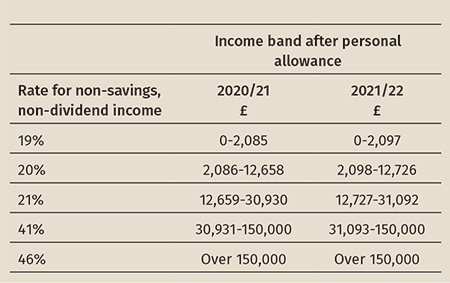

Tax Rates And Tables 2021 22 Budget Edition Rebecca Cave Bloomsbury Professional

What Should You Know About Inheritance Tax Best Citizenships

Capital Gains Tax Receipts Uk 2022 Statista

United Kingdom Tax Revenue August 2022 Data 1997 2021 Historical

Benefits Of Income Tax Return Filing Before Due Date Itr Filing Rules Income Tax Return Income Tax Income Tax Return Filing

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

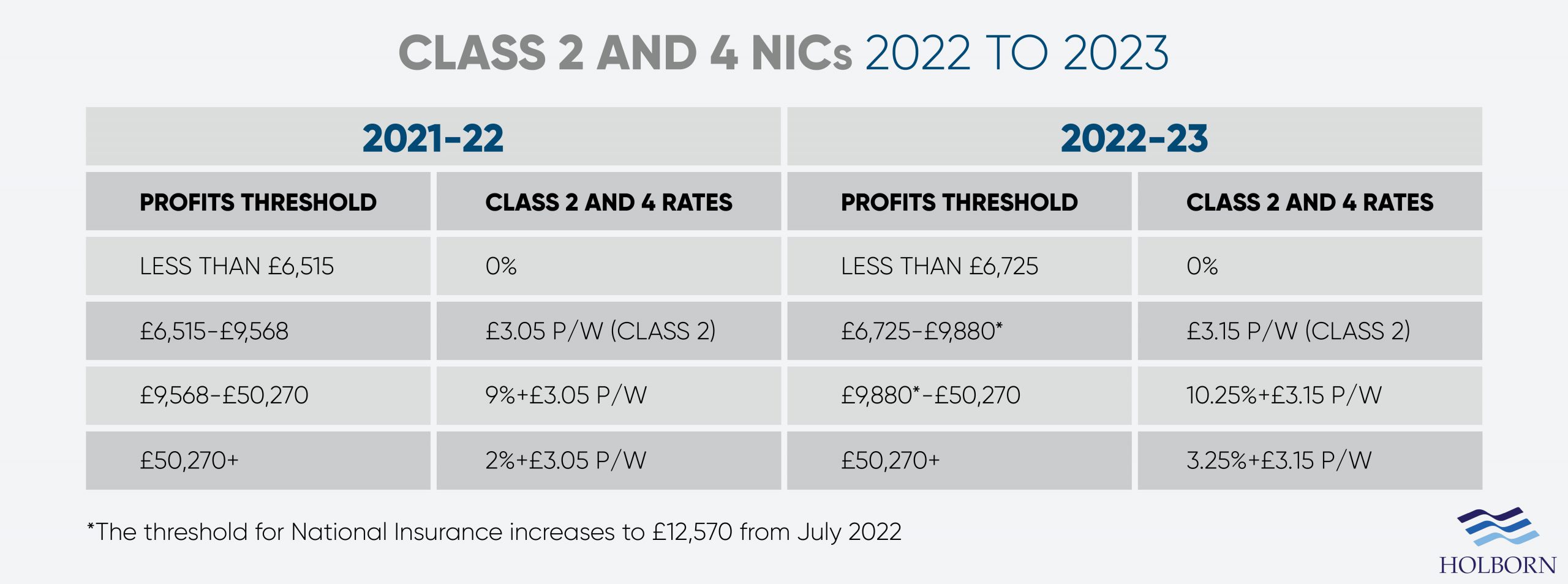

Changes To Uk Tax In 2022 Holborn Assets

What Are Marriage Penalties And Bonuses Tax Policy Center

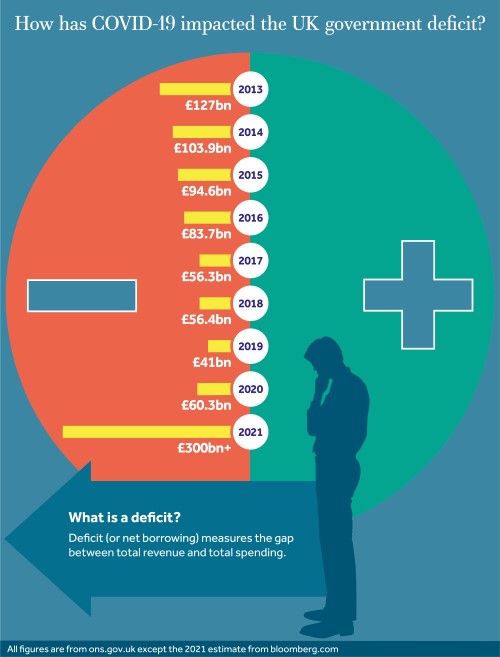

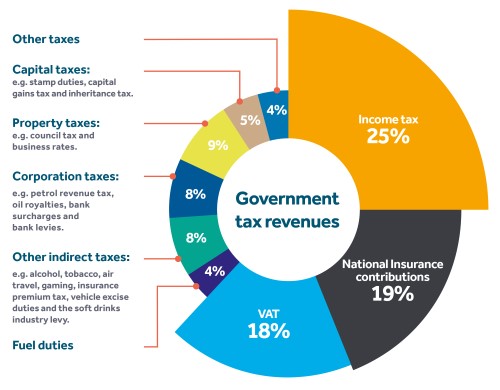

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Expat Guide To Buying Property In Florida Https Www Moneyinternational Com Expat Guide Buying Property Florida Fl Buying Property Orlando Theme Parks Expat

Corporation Tax Income Forecast Uk 2021 Statista

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

What Happened To The Expected Year End Estate Tax Changes

Inheritance Tax Receipts Uk 2022 Statista

Changes To Uk Tax In 2022 Holborn Assets

Budget Summary 2021 Key Points You Need To Know Budgeting Business Infographic Income Support